The House of Representatives on Wednesday approved on second reading three measures seeking to expand the benefits of senior citizens and persons with disability (PWDs).

During the plenary session, the chamber approved through voice voting House Bills (HB) 10312, 10313, and 10314, all of which aim to enhance the discounts, benefits, and privileges offered to senior citizens and PWDs.

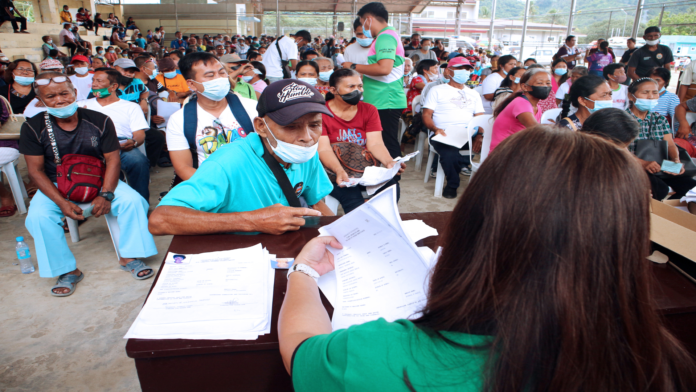

In his sponsorship speech, Agusan del Sur Representative Alfelito Bascug said the proposals would benefit around 12 million senior citizens and 1.5 registered PWDs.

“This will afford our PWDs and senior citizens greater financial relief as they struggle to have their budget for medical and food expenses at par with inflation,” Bascug said. “This vital legislation will surely uphold the preferential benefits rightfully deserved of these vulnerable sectors.”

HB 10312 proposes that the mandatory 20 percent discount, value-added tax exemption, and special discount on the purchase of basic necessities and prime commodities granted to senior citizens and PWDs be applied in addition to any prevailing promotional offers or discounts extended by business establishments.

It also clarifies that discounts granted to senior citizens and PWDs are deductible expenses of business establishments.

HB 10313, on the other hand, mandates a dedicated section in the eGov PH Super App to assist senior citizens and persons with disabilities in accessing government services, including healthcare, livelihood, social services, and informational resources.

Digital copies of the senior citizen identification (ID) or PWD ID shall be issued through the eGov PH Super App.

These digital copies shall be considered as a valid proof of identity of any senior citizen or person with disability for purposes of availing the rights and privileges they are entitled to under existing law.

The Department of Information and Communications Technology (DICT) shall be responsible for the integration of database of senior citizens and PWDs, as well as the integration of business establishments in the eGov PH Super App.

Meanwhile, HB 10314 seeks to rationalize the benefits and privileges of senior citizens and PWDs to ensure equitable access to essential services.

The bill introduces a 20 percent discount and value-added tax (VAT) exemption on parking fees and the use of expressways and skyways, as well as the grant of a 15 percent discount on the monthly utilization of water and electricity supplied by public utilities for the first 100-kilowatt hours of electricity and 30 cubic meters of water per month.

It likewise provides employers a tax deduction of 25 percent of the salaries and wages paid to senior citizen and PWD employees. (PNA)