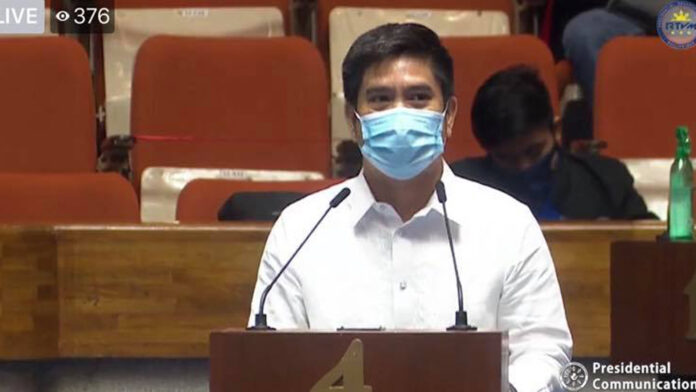

Agusan del Norte 1st District Representative Lawrence “Law” Fortun pushes for a “major upgrade” of the Solo Parents Act, which became a law 20 years ago.

Enacted in 2000, the Republic Act 8972 currently addresses the framework of solo parents and their children. However, Fortun believes that it fails to touch on the social and economic advantages surrounding the beneficiaries’ situations.

House Bill 8097, which was recently passed on second reading at the House of Representatives, shall provide financial aid to solo parents who have an annual income of less than P250,000.

According to a release issued by Fortun, HB 8097 defines a solo parent as someone “who provides sole support due to the birth of a child as a consequence of rape, the death of a spouse, the detention of a spouse for at least three (3) months, the incapacity of the spouse, legal separation for at least six (6) months, declaration of nullity or annulment of marriage, abandonment by the spouse, legal guardian, adoptive or foster parent who solely provides for the child, a family member who assumes the responsibility of the head of the family with the absence of the parent for at least six (6) months, and a pregnant woman who solely provides parental support to the unborn child.”

Under the bill, beneficiaries would also be entitled to VAT exceptions as well as a ten percent discount on commodities such as children’s clothing, baby milk and micronutrient supplement, medicines, vaccines for the child of solo parent, medical and dental services, and school supplies.

Additionally, HB 8097 would also assign workplaces to dedicate a breastfeeding station for women.

“Establishments are encouraged to hire qualified solo parents by providing tax incentives for the establishments. Businesses may also avail of tax deductions from their gross sales or receipts when they provide discounts on the necessities of the children of solo parents,” Fortun said.

“All these provisions are stated in the bill for the sole purpose of uplifting the quality of life of solo parents and their children. Raising a child takes a village and it is hoped that this bill will make each and every solo parent know that the country, its lawmakers and the government are supportive of solo parents and their struggle to provide for themselves and their child or children,” Fortun added.